Underwriting a student loan is a bit unique of other types out-of financial obligation. That have private financing, you nonetheless still need to endure an affirmation processes, but with federal funds there are quicker strict standards.

Of a lot otherwise the enterprises checked render settlement to LendEDU. These types of income is how exactly we maintain our free provider for consumerspensation, together with days out of for the-breadth editorial look, determines where & exactly how people show up on our web site.

To your cost of university fees broadening each year on the Joined Says, many people finish playing with student loans in order to help spend the money for will set you back.

You can look to possess grants and you may save up around you are able to, however you can still keeps a funding pit. That’s where making an application for this page college loans can be found in.

That have private student education loans, whether or not, there is certainly an underwriting techniques. This really is like financial underwriting or underwriting having a keen auto otherwise unsecured loan, however, discover differences too.

What exactly is Mortgage Underwriting?

When loan providers attempt to decide if you are a great risk before generally making a last choice, they take you by way of an underwriting techniques. This step was created to dictate the alternative that you’ll have the ability to pay your loan.

Your credit report is pulled, with your credit score, bank comments, money, and you may tax returns. So it papers is commonly thought to figure out if you’ll end up able to handle monthly installments later. Toward private education loan underwriting processes, your own university choices and you may big will also be sensed, instead of a mortgage software.

Comprehend, regardless of if, that with government student loans, there isn’t a comparable underwriting procedure. Sponsored and you can Unsubsidized Head Financing are available to undergraduate and you may scholar college students, no matter borrowing condition. Government In addition to funds for moms and dads and you will grad pupils, regardless if, carry out want a finite credit assessment.

When bringing personal student education loans, you will be subject to the fresh new underwriting techniques, like would certainly be for many who desired to borrow having fun with other types of debt. Right here is the action-by-step process of the mortgage app and you will underwriting process for a great private student loan.

Information you need add

Because you get a personal student loan, you need to collect particular paperwork and also have distinguishing recommendations offered for the underwriting processes. Before you can over a software having an educatonal loan, be sure to have the adopting the guidance offered:

- Label

- Birthdate

- Personal Coverage count

- Driver’s license and other state-awarded ID count

- Newest physical address

- Phone number

- Money

- Personal debt money

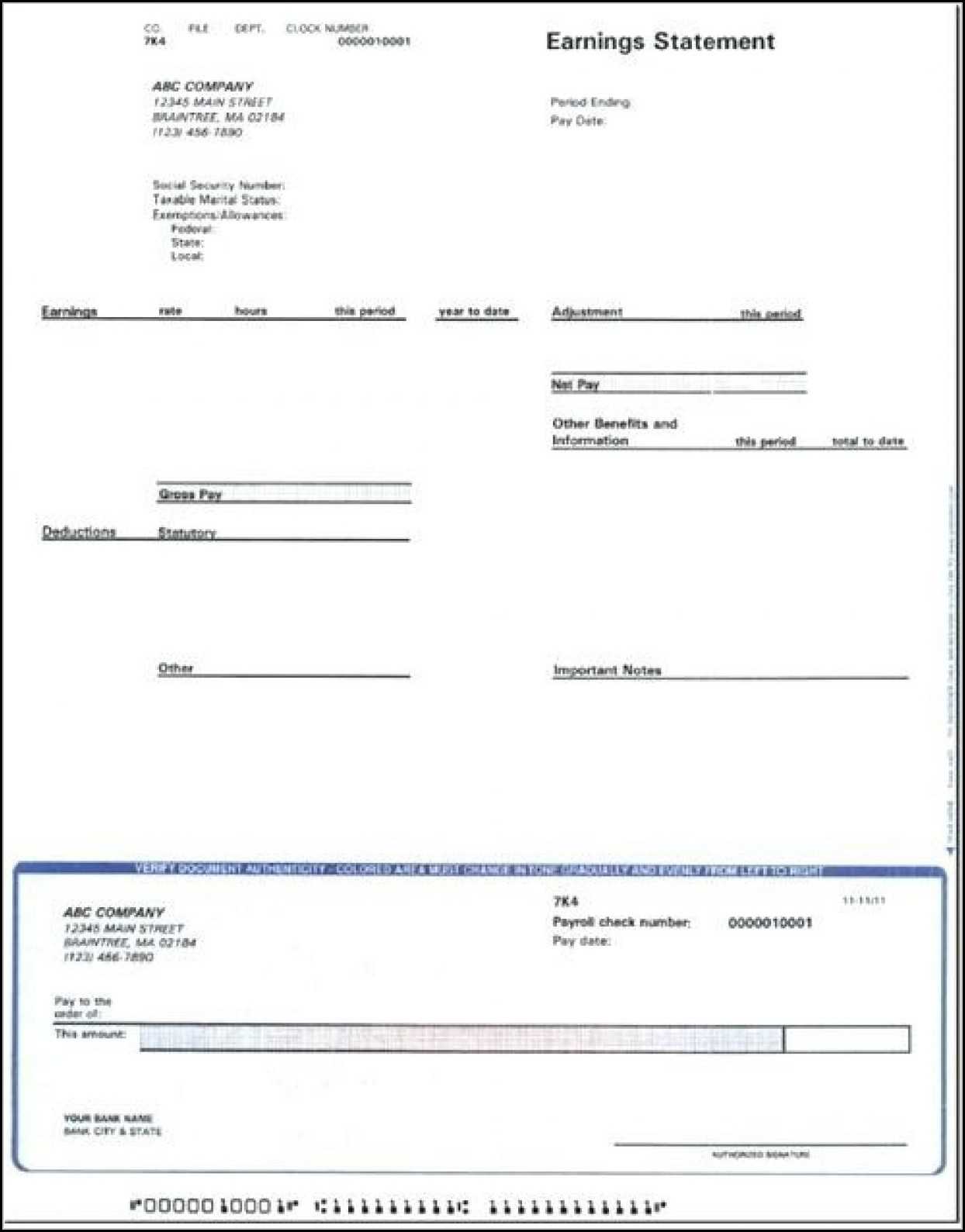

You can also be required to publish even more records, including duplicates of records one to establish your states. For example, tax statements and you will spend stubs, also lender statements, may help mortgage underwriters make sure your earnings. Your lender statements may additionally assist underwriters observe how much your owe and you can everything you shell out per month on your own personal debt or place any possible red flags, hence refers to the debt-to-money proportion.

Whenever making an application for personal college loans, you also need to fairly share which colleges you’re applying to, exactly how much you want so you’re able to use, and if you would expect in order to scholar. Specific programs require your arranged biggest also.

In the end, really loan providers along with will let you create a beneficial cosigner with the application for the loan. This individual offers the burden getting cost and his awesome otherwise their credit would-be noticed from the underwriting process.

This new Approval Choice

Personal banks and you will lenders make recommendations your render in your financing document and determine when they need certainly to present resource. It remove your credit report and look at your credit score to find out if you have got a great history which have while making money on your personal debt. They’re going to plus check your cosigner’s credit history, if you have you to.