Delivering a home loan which have Less than perfect credit

If you have bad credit and you will anxiety you’ll face financing denial when making an application for a home loan, don’t get worried. You may still be capable of getting home financing with a great reasonable credit rating. Obviously it can rely on several factors, so your best option to find out if it is possible to be eligible for a great mortgage would be to keep in touch with a loan provider. Of numerous loan providers gets a conversation to you concerning your eligibility no obligation to apply for financing.

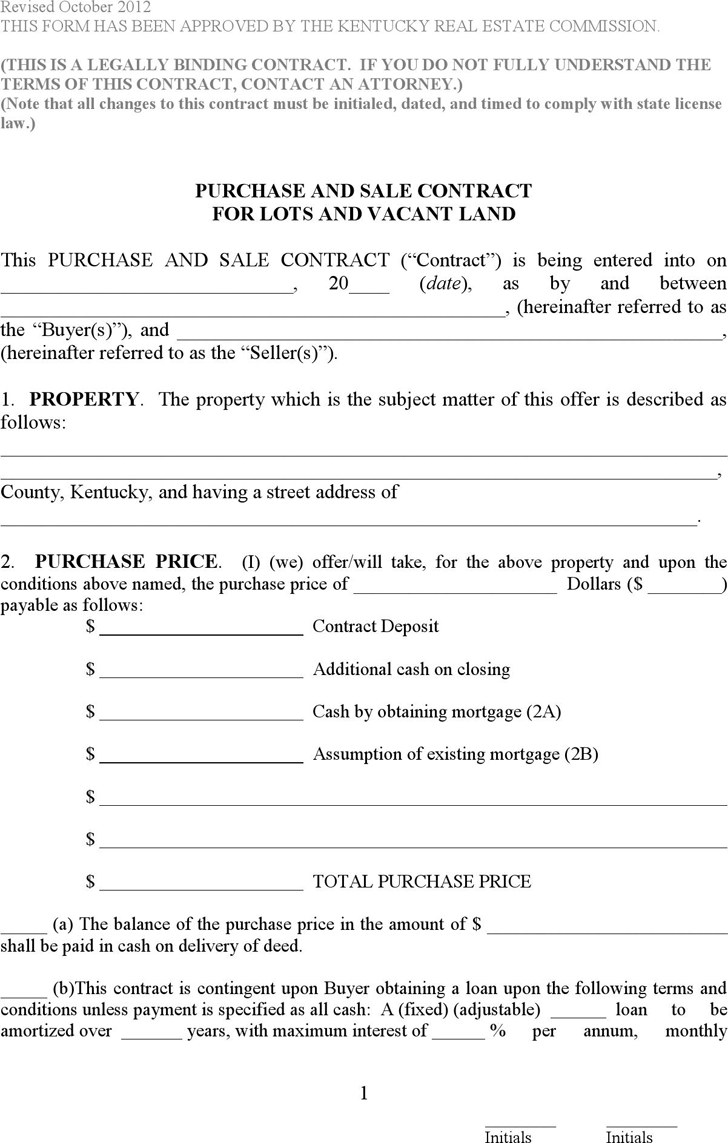

Exceptional credit = 800 and you will over Very good borrowing from the bank = 740 in order to 800 Good credit =670 so you’re able to 740 Reasonable credit = 580 to 670 Less than perfect credit = lower than 580

Even although you have reasonable credit, you may still find choices for to get a home. Certainly one of other certification conditions, mortgages will get credit rating requirements. The minimum credit history you may need hinges on the mortgage style of. Particularly, the minimum need score getting old-fashioned loans was 620. Although FHA mortgage program allows for credit scores of 580. So if low borrowing will continue to dog your, a keen FHA financing might be your best option. But think of, lenders may also have various other requirements considering other factors particularly since your down-payment matter or income.

Fixing or Blocking Poor credit

With bad credit is not necessarily the stop of the globe. It still can be possible for loan providers to present a good mortgage, offered your credit score is not all that lower. However, know that you can even pay emergency loan near me a higher interest plus costs as you are very likely to standard (neglect to afford the mortgage back). So it’s to your advantage to alter your credit rating receive a lowered interest rate, that may help you save many in the end.

Lenders look at the decades, dollars number, and you can payment reputation of your various other lines of credit. Meaning opening account seem to, running up your stability, and you will investing punctually or not anyway make a difference to their credit history adversely. Simply switching one among these areas of their expenses behavior normally undoubtedly apply at your credit rating.

There are ways you can change your credit rating, like paying down your debts, investing their debts punctually, and you can disputing you’ll be able to problems on the credit report. However, on the bright side, there are methods you can hurt their rating, so think about:

- Usually do not intimate an account to remove it from the report (it generally does not work).

- Cannot discover a lot of borrowing membership during the a brief period off day.

- Cannot take a long time to look around for rates. Lenders need remove your credit report each time you get credit. If you’re doing your research with various lenders to have a lower interest, discover fundamentally a sophistication chronilogical age of on the a month in advance of their score is inspired.

Even if you have corrected the latest downward spiral of your own borrowing from the bank record, you will need to tell a prospective bank that there could possibly get end up being specific signs of poor credit on your own declaration. This may help you save big date, given that he/she will look from the some other money than he you are going to if you don’t.

If you are nevertheless having problems providing financing, pose a question to your lender as to why. Poor credit is one of multiple reasons you will be rejected financing. Almost every other grounds you might be refuted a home loan were:

- Overextended handmade cards: For folks who miss money otherwise exceed their limitation, that is a red flag to help you loan providers.

- Inability to invest a previous otherwise established financing: When you have defaulted into the most other financing, a loan provider have a tendency to wait.

- Bankruptcy: Filed for case of bankruptcy in past times 7 years? Maybe you have trouble bringing a loan.

- Overdue taxation: Lenders check your taxation commission listing.

- Judge judgments: If you have a judgment against your getting such things as unpaid child assistance money, it might damage your borrowing.

- Collection agencies: Lenders can ascertain if collection agencies need your.

- Overreaching: You are seeking that loan external what you are able reasonably manage.